In 2025, U.S. lawmakers introduced a remittance tax as part of sweeping reforms under the One Big Beautiful Bill Act (OBBBA). This legislation has major implications for Money Services Businesses (MSBs), their customers, and the broader remittance market.

What Was Proposed?

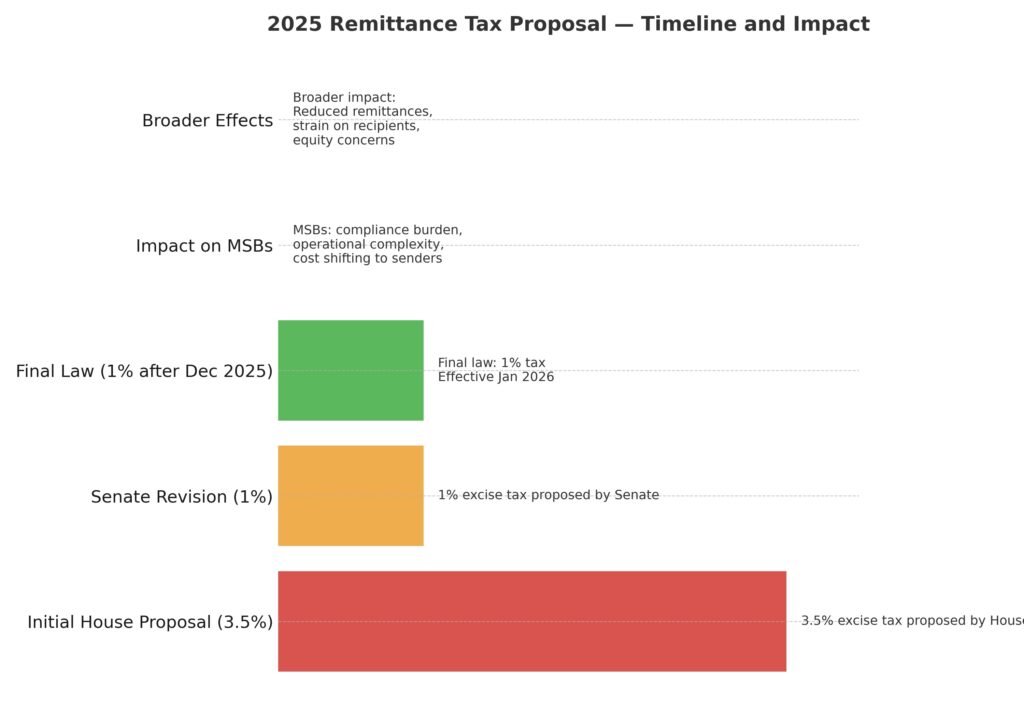

The House of Representatives initially proposed a 3.5% excise tax on remittances, aimed at outbound transfers to foreign countries. U.S. citizens were to receive a carve-out from this tax. The Senate, however, narrowed the scope and proposed a 1% excise tax that applied primarily to cash-based or in-person transfers, excluding electronic remittances processed through regulated institutions like banks or credit cards.

Did the Law Pass?

Yes. On July 4, 2025, President Donald Trump signed the OBBBA into law (Public Law 119‑21). Among its provisions, it included a 1% remittance excise tax on qualifying outbound transfers made after December 31, 2025.

What Does This Mean for MSBs?

The new tax has several implications for MSBs:

– Increased Compliance Burden: MSBs must collect and remit the 1% tax for applicable transactions, creating new administrative responsibilities.

– Operational Complexity: The tax applies mainly to cash-based transactions, creating complexity in tracking which transactions are taxable.

– Cost Shifting to Senders: Customers will bear the cost of the tax, which may reduce their use of formal remittance services.

– Potential Drop in Formal Remittances: Higher transaction costs could push some senders toward informal, unregulated channels.

Broader Economic and Social Impacts

Beyond the operational burden for MSBs, the remittance tax is expected to have far-reaching consequences:

– Strain on Recipients Abroad: Countries that rely heavily on remittances, such as El Salvador and Guatemala, may see reduced inflows of capital.

– Discriminatory Impact Concerns: The tax disproportionately impacts immigrant communities, raising concerns about equity and fairness.

Summary Table

| Topic | Details |

| Initial House Proposal | 3.5% excise tax on remittances; carve-out for U.S. citizens |

| Senate Revision | 1% excise tax, limited to cash-based transfers; electronic transfers excluded |

| Final Law | Enacted July 4, 2025; 1% tax effective after December 31, 2025 |

| Impact on MSBs | Added compliance burden, operational complexity, and potential customer migration to informal channels |

| Broader Effects | Strain on remittance-dependent economies; disproportionate effect on immigrant communities |