Aviara is a leading advisor in U.S. Money Services Business (MSB) licensing, offering turnkey solutions for multistate license acquisition, regulatory structuring, and compliance setup. Since 2005, we’ve helped fintechs, international banks, and payment providers establish scalable MSB operations across the United States. Whether you’re pursuing a new license or expanding an existing financial structure, we provide expert guidance at every step.

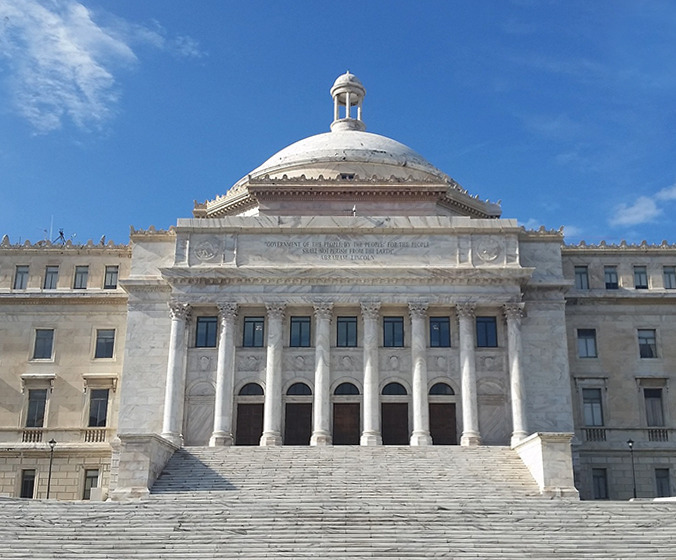

Our primary focus is on supporting fintechs, payment processors, and international banks in structuring and licensing multistate MSBs in the United States. While much of our work involves e-commerce acquirers, clients operating under Puerto Rico’s IFE framework, we also assist financial institutions throughout the Caribbean, Latin America, and other key jurisdictions—including Mexico and Switzerland—where cross-border MSB integration is part of a broader international financial strategy.

Aviara is a leading advisor in Money Services Business (MSB) licensing and regulatory structuring. Since 2005, our team has guided entrepreneurs, fintech companies, international banks, and payment processors through the complex process of establishing compliant financial entities in the United States. We specialize in multistate MSB licensing under the 2025 MTMA framework and offer turnkey solutions that accelerate your market entry while reducing compliance risk.

Our core focus is building scalable MSB structures that power modern financial services — including international remittance platforms, credit card issuers, digital wallets, and embedded finance products. We navigate the evolving regulatory landscape across 30+ MTMA-adopting states to ensure your MSB is not only licensed but also audit-ready and built for long-term growth.

In addition to licensing, we provide full compliance infrastructure, application preparation, audit coordination, and regulatory communication. We help clients connect with BIN sponsors, integrate with ACH and wire processors, and structure offerings in a manner consistent with both state and federal expectations. For startups and established institutions alike, our MSB advisory services bring clarity and execution to an otherwise fragmented and high-stakes environment.

While we serve clients across the United States, much of our work is focused on building MSBs that complement existing financial licenses — particularly for Puerto Rico IFEs and international banks seeking access to U.S. payment rails. Our experience with hybrid models that combine a Puerto Rico banking license and a U.S. MSB creates powerful operational synergies for global banking clients.

We understand the regulatory and practical complexities of structuring MSBs for domestic and foreign institutions. If you’re exploring the U.S. MSB market for your fintech or bank, we welcome you to contact us. Our team will guide you through every step of the licensing and compliance process with confidence and precision.

Copyright © 2025 Aviara Advisors LLC