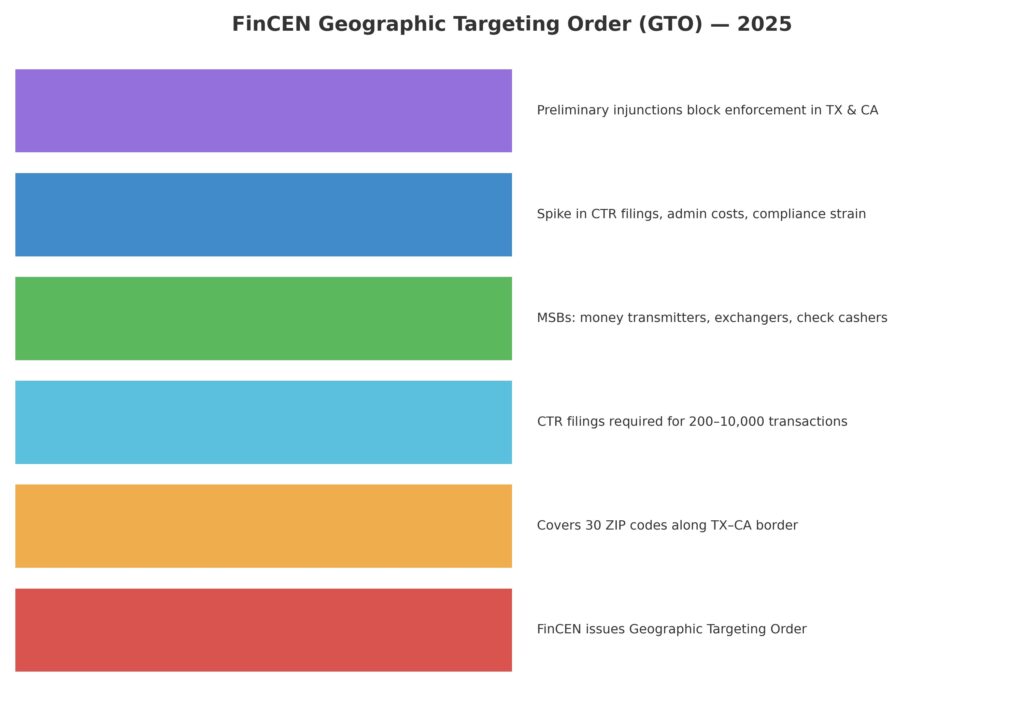

In March 2025, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) issued a sweeping Geographic Targeting Order (GTO) that imposes new reporting requirements on Money Services Businesses (MSBs) operating along the U.S.–Mexico border. The order is aimed at curbing illicit finance and drug cartel activity but carries significant consequences for MSBs.

Overview of the GTO

On March 11, 2025, FinCEN announced a Geographic Targeting Order (GTO) requiring heightened reporting from MSBs located in 30 ZIP codes along the U.S.–Mexico border in California and Texas. Under the order, any MSB conducting cash or currency transactions between $200 and $10,000 must file a Currency Transaction Report (CTR) with FinCEN. This lowers the standard reporting threshold, which is normally set at $10,000 under the Bank Secrecy Act (BSA).

Scope & Requirements

The GTO applies broadly to MSBs defined under the BSA, including currency exchangers, check cashers, money transmitters, and providers of prepaid access. Key points include:

– Covered transactions: deposits, withdrawals, exchanges, or transfers in cash between $200 and $10,000.

– MSBs must verify customer identity and file CTRs for each covered transaction.

– Suspicious transactions identified during this process must be escalated via SAR filings.

– The GTO took effect on April 14, 2025, and is scheduled to run through September 9, 2025, unless extended.

Strategic Objectives Behind the GTO

According to Treasury officials, the purpose of the GTO is to combat money laundering and illicit finance linked to Mexico-based cartels. The initiative complements other federal measures, including the designation of several cartels as Foreign Terrorist Organizations (FTOs) and Specially Designated Global Terrorists (SDGTs).

Compliance Challenges for MSBs

The GTO creates significant compliance burdens, particularly for smaller MSBs unfamiliar with CTR filing. Challenges include:

– A sharp increase in CTR filings, potentially overwhelming compliance staff.

– Additional administrative costs for verification, recordkeeping, and reporting.

– Increased risk of errors and potential enforcement penalties.

– Short implementation timeline, leaving MSBs with limited time to adapt.

Legal Pushback & Injunctions

Several MSBs, supported by trade groups such as the Texas Association for Money Services Businesses (TAMSB), have challenged the GTO in court. They argue that the order is financially ruinous, disproportionately impacts small businesses, and oversteps regulatory authority. In response, federal courts in San Antonio and Southern California granted preliminary injunctions, halting enforcement of the GTO for certain MSBs in those regions.

Quick Summary Table

| Aspect | Details |

| GTO Issued | March 11, 2025 |

| Effective Period | April 14 to September 9, 2025 |

| Who’s Affected | MSBs in 30 ZIP codes along the Texas–California border |

| Reporting Threshold | Cash or currency transactions from $200 to $10,000 |

| Primary Impact | New CTR requirements, identity verification, potential SARs |

| Purpose | Curb laundering linked to Mexico-based cartels |

| Legal Status | Preliminary injunctions block enforcement for some MSBs in TX & CA |

Final Thoughts

FinCEN’s GTO represents one of the most aggressive compliance shifts for MSBs in recent years. While the measure is designed to strengthen AML controls along the Southwest border, it places a heavy burden on legitimate businesses. The outcome of ongoing legal challenges will determine whether the order is scaled back, extended, or permanently enjoined.